#371 | Hybrid Life/LTC – The Sand Wedge of Insurance Products

This article is authored by Steve Cox, Head of Life and Hybrid Products at Life Innovators. Special thanks to Ramona Neal of The Living Benefit Review for her assistance.

Even for someone steeped in knowledge of traditional life insurance, the hybrid life/LTC market can seem a bit mystifying. These products have a death benefit, but only at the absolute minimum level to still qualify as life insurance and some even decrease over time. Historically, hybrid products have been sold a single-pay MECs. Policy cash values rarely grow and often burn off, but the contracts maintain surrender values and stay in-force with separate riders. And on top that, the “traditional” hybrid model is being upended by new products from companies like Lincoln and Brighthouse but taking a different approach to the actual policy design.

It’s not surprising, then, that advisors often have conflicting thoughts about the space. They recognize that clients have a need for Long Term Care coverage and that traditional LTC options are limited. But at the same time, they feel intimidated by the breadth and depth of the hybrid market, with all of its nuances and niches. To use a golf analogy, most advisors have experience in what they hit the most – drivers, irons and putters. Invariably, however, even good golfers find themselves lodged deeply in a strategically placed greenside bunker. And for that, there is no substitute for the sand wedge. It has one single focus – to reliably get you out of the trap. It’s the club that no one really wants, but everyone needs. And the same goes for hybrid life/LTC.

In this article, we’re going to tackle a high level overview and brief history of the marketplace. In our next article, we will get into more details on case design, product configurations, and some views about where the bang for the buck resides in these products.

The Basics

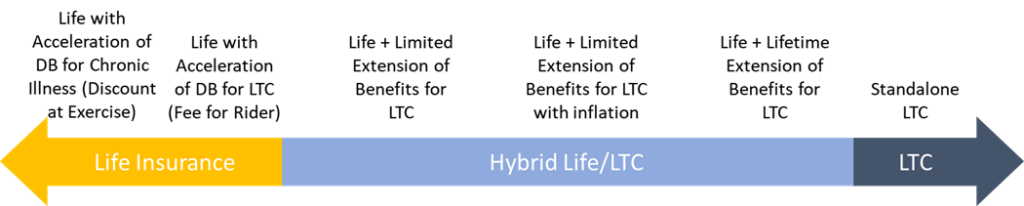

Let’s start at the beginning – what is a hybrid product? The simplest definition that delineates a hybrid product from other LTC solutions is that it is a life insurance policy with a long-term care rider that can accelerates a total LTC benefit that is greater than the death benefit. Accelerations for qualified LTC claims beyond the amount of the death benefit are called Extension of Benefits. These sorts of products slot between life insurance policies that allow for acceleration of benefits for qualified CI and LTC claims, which are practically table-stakes at this point, and true standalone LTC. If you imagine a spectrum of LTC-ness, it might look something like this:

There’s a barrier between life insurance policies that offer acceleration riders and true hybrid products that offer an extension of benefit payments beyond the total death benefit. Hybrid products are functionally a separate product category geared specifically to clients with LTC concerns, rather than accumulation and retirement income. These products have cash values, but they aren’t accumulation focused.

The adage from the hybrid carriers is this: regardless of outcome (surrender, death, LTC claim), the policy pays a benefit. Live-Quit-or-Die, or LTC-Surrender-Death, something pays out. The premium may be high, but it covers both LTC risk and mortality risk in one unified package, with no discounting of the death benefit on acceleration as is often found on traditional life policies. The death benefit can be used for LTC or death benefit, but not both. If part of the death benefit is used for LTC, the remainder stays available as a death benefit. And distinguishing it from some for-cost LTC riders in traditional life insurance policies is the unique extension of benefits for LTC if the death benefit is exhausted.

That’s why the sand wedge is such a good analogy for hybrid products. Like the sand wedge, hybrid products are designed for a very specific purpose – an LTC sale. But also like the sand wedge, hybrid products are not purely single use. That’s the beauty of the design. Unlike standalone LTC, which is purely single use, hybrid products offer “outs” in the form of cash value and death benefit. That’s what makes them so appealing but, at the same time, so mystifying for traditional life insurance agents.

Anecdotally, the majority of hybrid product early growth was due to former stand-alone LTC producers, with traditional producers slowly adopting the product. With problematic long-term care experience driven more by low lapse rates and declining interest rates rather than actual care claim rates, many stand-alone carriers have exited the market and those LTC producers have gravitated to hybrid product sales. There doesn’t seem to be an issue for traditional LTC producers in transitioning to life/LTC hybrid products because the focus of the sale is still LTC. The only difference is the structure of the solution.

Life insurance agents, however, are not used to this sort of “sand wedge” approach. They’re used to pulling putters, irons and drivers. In other words, they’re used to playing off of the nice, smooth grass of protection and accumulation life insurance sales. If only the real world worked that way. The reality is that most clients have an uninsured long-term care need. And for that, there’s really only one option these days – hybrid life/LTC. With a bit of practice, most agents will pick it right up.

Not an Accumulation Game

Hybrid products have cash value, but when you look at a hybrid product illustration, don’t expect to be blown away at how they accumulate. The internal product charges for LTC will suppress growth, and this will get exaggerated if you add inflation to the illustration. A slight advantage that hybrid products do have is an incredibly long duration – primarily the result of ultra-low lapse rates – which can help on the investments side by going long (which helps in a normal interest rate environment, not so much today) and the ability to consider less-liquid assets that can generate additional yield. However, those investment advantages are far outweighed by the internal costs of the dual risk of LTC and death.

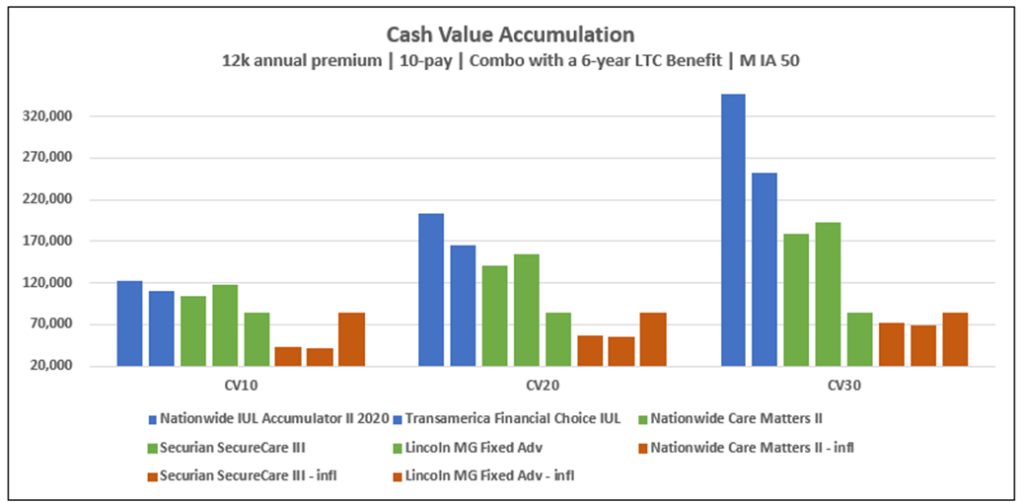

Let’s take a look at some of the leading hybrid products accumulation, versus a couple of typical permanent products.

The blue products are typical permanent products – Nationwide’s IUL Accumulator II and Transamerica’s Financial Choice IUL. The green bars are three combination products, run without inflation. The orange bars are those same combination products, but including inflation (again, the popular structure in today’s market).

After 10 years, the hybrid products without inflation aren’t too dissimilar to permanent – but tenth year CV is hardly the focal point of accumulation products. Going out to years 20 and 30 really shows how the hybrid products simply aren’t designed to keep up with traditional products. Add the prevailing inflation option of 5% compound, and there simply isn’t much to get excited about on the accumulation front. But that’s not what they were built to do.

A way to view the CV20 on a no-inflation sale is that your CV is a bit more than return-of premium for 2 of the 3 products. 120k of premium paid in, and between 140k and 150k in CV by that time (other than Lincoln, which has more of a focus on a percentage return-of-premium option to choose.) It’s not a terrible deal – focus on LTC, and worst-case scenario (lapse), you’ll get your money back. That story holds water.

But accumulation isn’t the sole focus for every client sale. Some clients have other risks to address depending on their life goals. And those goals need other solutions. Accumulation-only sales need the big club. You don’t tee off on a par 5 with the sand wedge, you use that monster driver. But when a client brings up that LTC concern, you should be ready to sacrifice some of that accumulation story to address it. Much like needing that sand wedge when the approach shot finds a green-side bunker.

Focus on LTC

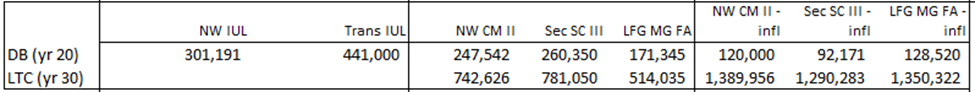

Where is the money going, if not to accumulation? Of course, it’s going to LTC. Check out the death benefit (duration 20) and LTC benefit (duration 30) in those scenarios:

Check out those LTC benefits that are available at year 30, which is attained age 80 in this example. It’s impressive enough to see 500k to 700k of LTC benefits available in the no inflation scenarios. However, those depressed duration 30 CV’s shown earlier don’t look so bad when you see over $1 M of LTC benefits available in the inflation scenario. And remember, this is on a 120k premium outlay over 10 years. You can see why this sale is hyper-focused on inflation concerns, and why traditional LTC advisors have made their way over to this product.

Market Participants

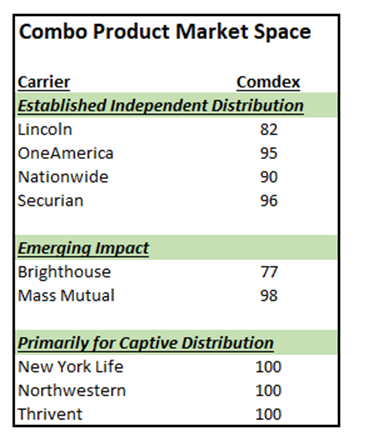

Make no mistake about it, this is a niche market for carriers. The brokerage space is generally the domain of four carriers, and a few traditional distribution carriers have developed products for use by their producers. Here’s the list, and honestly, this is it – it’s not just a subset of the top ten, this IS the market. And take a look at the Comdex ratings of these carriers. By and large, they are financially strong, well-respected carriers with whom you should feel comfortable placing a long-term product.

Why so few carriers? Two reasons. First, the market in and of itself isn’t that big. Second, the barriers to entry are fairly high relative to many of the well-known products like Indexed UL and Fixed Index Annuities.

Market Size

When a carrier looks at those barriers, they need a reward that is worthwhile. Many carriers will look at the space and decide that it’s simply not a big enough market as it stands today. Where will it be tomorrow? Hard to say, but there’s no crystal-clear path to say that it’s going to explode.

In 2022, there were 5.2 million life policies written in the US. 2.2 million of those were term, and a big chunk of policy count comes through from final expense insurance, but even weeding those out will leave around 1.4 million traditional, permanent life policies written. Hybrid? Between 15,000 and 20,000. That’s it. Not a lot of room to spread it around.

That said, the premium per policy is much higher than traditional life’s industry average. Again eliminating term and final expense, permanent products average around $7,000 of annualized premium per policy. Hybrid sales have an attractive $17,000 average annualized premium based on a typical case design. Carriers not currently in the market will be tempted by the potential, but as it stands today, those outsiders will need to buy in to the growth potential of the market to make the leap.

Barriers to Entry for Carriers

For a market that has so few competitors, even with a small size, one might initially think that carriers would be flooding to fill it. The companies currently in the space will often talk about the relatively stable and sane pricing, the consistency in production, and the power of the internal dynamics of the product that make it difficult to break. We’ll set aside that last point, as the actuarial set has published plenty of research about the internal hedging within the product, and how that makes the carrier’s IRR surprisingly stable through a battery of assumption sensitivities. Instead, we’ll look at the hurdles that we hear from clients considering the space.

- LTC, three 4-letter words. We have had discussions with several carriers who would seem to be a fit for this space whose response is point blank, “we can’t do anything that looks like LTC”. Too much scar tissue for those who were stand-alone carriers. Too much feedback from their Board about LTC-looking products. Too much perceived reputational or ratings risk. The analytics at the carriers may like the risk, especially given ongoing research from various actuarial organizations, but they simply can’t touch LTC with a ten-foot pole.

- Underwriting. First off, LTC underwriting is materially different from life underwriting, and most carriers don’t have that kind of underwriting expertise in-house. Underwriters need to understand cognitive tests. They need to be able to interpret interviews focused on morbidity. They need to understand morbidity risks from various diseases, impairments, or medications rather than their mortality implications. Some carriers have tried to cross-train mortality (life) underwriters to LTC/Hybrid underwriters, but very few have been able to pull it off successfully. Which leads to a key second point, which is that a new carrier may look to outsource the lifeblood of risk assessment to a third party. No carrier likes to outsource such a critical function; few carriers have the capability to build it. Over the next few years, hybrid products will continue to automate underwriting, much like the path that traditional products have taken. However, there is still much to learn about assessment of cognitive function and morbidity impacts from the sources utilized by life underwriters. New entrants will need to have confidence in new underwriting techniques and build relationships with experienced partners to effectively underwrite and manage risk.

- Speed to Issue. Very few things are under as much pressure at carriers than underwriting turnaround time and speed to issue. Automated underwriting is all the rage in the life space. However, with hybrid products, morbidity risk is paramount, and automated underwriting is still maturing and evolving as it relates to morbidity protection. Yes, there are Rx checks and medical data that can help, but carriers will be very cautious about giving up deeper underwriting, especially at issue ages over 55 or 60 (a key demographic for hybrid products). With that knowledge, potential new carriers are hesitant to give the perception of “slow underwriting” when their distribution outlets are demanding faster and faster.

- Actuarial Modeling. I’ve been in the industry for 35 years, and I don’t mean to be hyperbolic by saying this, but hybrid is the most complex product to model and price. Second place isn’t really very close. The pricing models need to incorporate the inter-related assumptions of persistency, mortality, and morbidity. With joint designs, the complexity doubles. Claimants can come and go off claims, with those events impacting the mortality assumptions. Of course, mortality assumptions have to be differentiated between active lives and disabled (on claim) lives, while total mortality remains consistent. Many modeling actuaries utilize Monte Carlo models, running millions of simulations – which has advantages, but also challenges when it comes to reserve and capital calculations. All of this is further complicated by…

- Data Challenges. The industry, through the Society of Actuaries and some consulting firms, has done a good job of working through the difficulty in stand-alone LTC experience. Much of this was forced on the industry and carriers because of the challenges facing the stand-alone business. However, the carriers with experience in hybrid products know that stand-alone experience is different from hybrid experience. Intuitively, it makes sense – – because hybrid products pay a death benefit, there is some inherent incentive for the policyholder to defer tapping into the acceleration benefit in order to preserve it for their heirs. But how much is that reduction in claim incidence rate? And because hybrid incidence rates are lower than stand-alone, does that make hybrid claims “more severe” once they do claim? And what constitutes a “more severe” claim when it comes to LTC – – shorter time to death, or longer time on claim? These are obviously critical assumptions for the hybrid product – – and there are no industry studies published for hybrid. None. Carriers with the experience are loathe to share that proprietary information. There has not been an incentive for them to do so, as most of the established hybrid carriers will say that their experience has been largely in line with pricing. Therefore, new carriers are somewhat flying blind on some of the most critical actuarial assumptions.

- Administrative Platforms. Most carriers struggle with admin platforms, for numerous reasons. Hybrid products are not mainstream enough for admin platforms to have readily available solutions. As a result, significant customization is necessary to handle the necessary complexities of combination products. Companies are so bogged down with other admin issues on legacy blocks, other product innovations, etc., that carving out resources to build a hybrid product doesn’t rise to the top of the priority list.

These hurdles are not easy to clear, and given the potentially small payoff, many carriers understandably put their resources elsewhere. However, with the potential that still exists in the LTC solutions space, there is nothing on this list that is impossible to overcome. It will, however, require a carrier that is committed, focused, and capable of execution. Many industry experts are projecting continued growth in the hybrid space, as awareness of the solutions grows, producers learn the products, and state mandates continue to push advisors to solve challenges for their clients.

Part 1 Summary

The marketplace for hybrid products is not huge, but it could be poised for growth if LTC continues to stay at the forefront of people’s minds. Advisors who have observed the true hybrid space from afar may want to consider a closer look at this unique product. Awareness of an LTC solution could get you well-positioned when a client brings up the concern, much like how a sand wedge is in your bag to get you out of that tough situation that you may be trying to avoid. There aren’t many carriers out there, so you may need to expand your portfolio of companies with whom you work to get the right product.

In our next article, we’ll get into more detail on the design components of these products, and how you can customize solutions. We’ll share some thoughts on where the real bang-for-the-buck is with premium dollars, which will certainly not align with each producer’s view on optimization. Look for that article within the next week!