#309 | Nationwide Advisory VUL

In the early 2000s, a little company in Louisville called Jefferson National began to make a serious splash in the annuity side of the business. Jefferson National – JeffNat – was focused exclusively on selling accumulation-oriented variable annuities with no commissions or surrender charges through RIAs. Its flagship product was Monument Advisor and it was marketed with the catchy tagline of “Flat is Beautiful,” referring to the product’s flat $20 per month policy fee. With Monument Advisor, JeffNat quickly came to dominate and define the fee-only VA side of the market.

In 2017, JeffNat was snapped up by Nationwide and rebranded as Nationwide Advisory Services (NAS). The model has remained largely unchanged and Monument Advisor lives on as a Nationwide product, still sporting a $20 per month policy fee. Nationwide has also built out other annuity products for NAS such as an updated version of Monument Advisor, a VA with an income rider and a SPIA, evidence of their ongoing commitment to serving the RIA community through fee-only products. And now that lineup also includes a life insurance policy – Nationwide Advisory VUL.

In broad strokes, Advisory VUL is arguably a VUL version of Monument Advisor. Both products market flat fees. In the case of Advisory VUL, the flat fee comes in the form of a level Protection Premium Deduction, which is essentially a term insurance structure embedded in the policy in lieu of Cost of Insurance charges for either 5 years or to a specified attained age. Both products have large fund lineups, more than 320 for Monument Advisor and 144 for Advisory VUL, which is about double the slate of a normal Variable UL product, including Nationwide’s retail VUL Accumulator product. Both products are focused exclusively on tax efficient accumulation, not income or death benefit guarantees.

If you consider the Protection Premium Deduction as sunk cost for term life insurance coverage that the client would have bought anyway, then the only explicit cost for overfunding Advisory VUL comes in the form of a state-specific premium load applied to any premium paid above the Protection Premium Deduction. There are no other surrender charges, unit loads or policy-level asset-based charges. It is essentially “buy term and invest the difference,” only in this case the “invest the difference” portion happens in a tax efficient life insurance policy rather than a taxable account.

The beauty of Advisory VUL is its purity. It is purpose-built for the specific use of life insurance as a tax-efficient vehicle for accumulation. Advisory VUL is, essentially, a retail Private Placement VUL product with the primary difference between the policies being the fund lineup (and commensurate investor and premium restrictions). But even on that score, Advisory VUL tracks closer to PPLI than a typical retail VUL with a slate of funds that are hedge fund-ish if not explicitly LPs.

Take, for example, the Virtus Merger VL fund, which is designed to be market-neutral exposure to merger arbitrage, a classic hedge fund strategy. The same goes for the Guggenheim VT Multi-Hedge Strategies, a fund of hedge funds, and plenty of other funds that fall into real estate, energy, infrastructure, specialty credit and other categories. Advisory VUL is bristling with alternative investment options that generally aren’t found in other retail VUL products. And because Advisory VUL doesn’t have an explicit asset-based charge like typical PPVUL policies, it stands to reason that Advisory VUL may perform as well or better than PPVUL assuming identical separate account performance and fees.

Advisory VUL is a clear threat to commission-based advisors selling retail life insurance products for accumulation. It sports low policy charges, no surrender charges and a mouth-watering fund lineup. What’s not to love? Advisory VUL is designed to convert the unconverted. It’s a Variable UL that even a perennial skeptic of life insurance like Dave Ramsey can believe in. But is it really the threat to retail VUL products that it appears to be?

I’ve long made the argument that, over the long run, retail life insurance products actually have more efficient policy charge structures than fee-based designs for the simple reason that asset-based charges and commissions on a cumulative basis end up far exceeding fixed charges and commissions in the early years of a retail product. That’s true for Private Placement – and it’s also true for Advisory VUL.

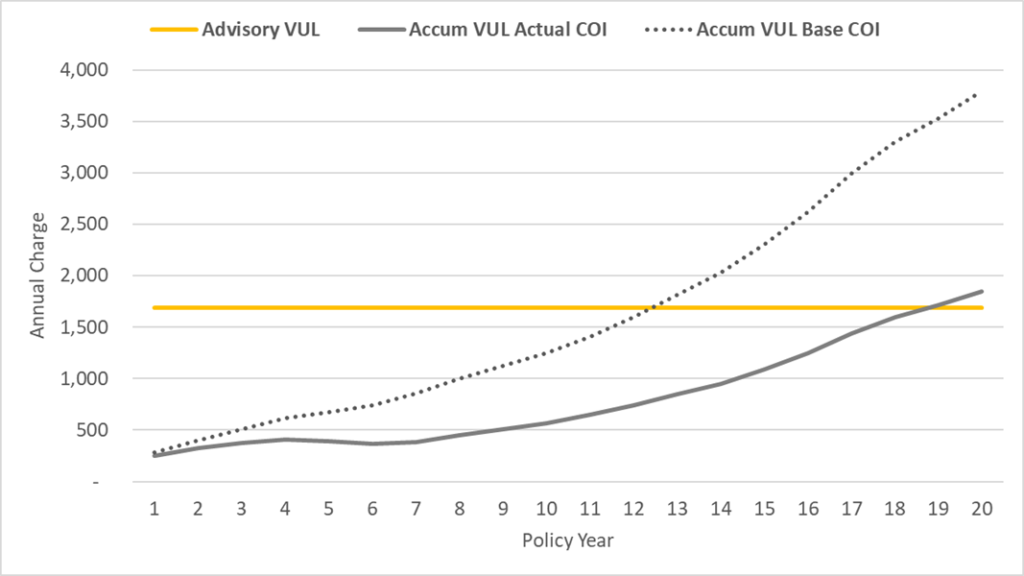

Dig one level deeper into the pricing elements of Advisory VUL and it becomes readily apparent that the story for the product is simplicity and purity, not pure accumulation efficiency. Let’s start back at the beginning with the concept of a flat fee that mimics an embedded term insurance premium. Would you really rather have a flat fee than a normal Cost of Insurance charge? Probably not. Consider that COI charges are denominated by Net Amount at Risk, which means that overfunding the policy necessarily discounts the COI charges. Take a look at the COI charges for the retail Nationwide product versus Advisory VUL for the same 45 year old Preferred Male illustrated at 6% gross. The dotted gray line represents COI charges for a constant $1M of Net Amount at Risk while the solid gray line represents the actual COI charges for a policy that has been funded to the maximum non-MEC limit.

If you wanted to simplify the story, you could say that the flat Protection Premium Deduction rate for Advisory VUL is the average of the base Cost of Insurance rates in Nationwide’s retail VUL Accumulator product. But the difference, of course, is that there is no discount in Advisory VUL for a decreasing Net Amount at Risk. And that difference adds up. Over 20 years, the PPD in Advisory VUL tallies up to $33,700, a little bit more than double the $16,148 in COI charges for VUL Accumulator. Advisory VUL is, quite literally, buy term and invest the difference – which means that you should always use Option 2 for the entire flat charge period of Advisory VUL because the mortality charges are the same whether you have a diminishing Net Amount at Risk or not.

However, don’t make the leap to assume that the term-like rates in Advisory VUL are the same price as Nationwide’s retail term insurance product. They’re not. Based on the few cells I looked at, Advisory VUL is 20-30% more expensive than Nationwide’s retail term product, 40-45% more expensive than the cheapest product in the market and just a shade less expensive than the most expensive term product I could find.

But that shouldn’t be a surprise. As I’ve written before, Term pricing usually assumes profitability coming primarily from the post-level term period, which doesn’t exist in this product. Furthermore, this is a VUL product, which means the administrative costs are higher than in a Term policy. And, finally, in absolute dollar terms the amount is trivial. A 40% differential sounds like a lot, but consider that it’s less than $500 for this sale – against $75,000 in annual maximum non-MEC funding. It just ain’t that big of a deal. Beyond the initial period of level charges, Advisory VUL essentially converts into a clone of VUL Accumulator in terms of COI charges, with the difference of $300 each yet – yes, a flat, level $300 dollars. Flat is beautiful.

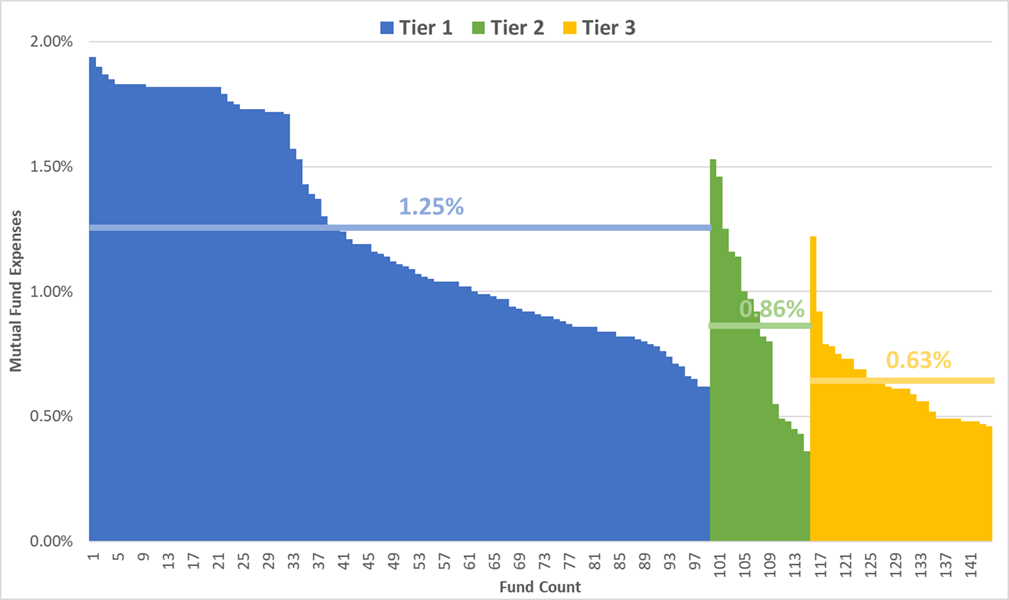

However, the difference in mortality charges between the two products is a rounding error compared to the difference in asset charges. VUL Accumulator, the retail product, has no M&E and sports a massive guaranteed 0.4% account value bonus starting in the 6th year that’s conditional on the policy being overfunded. Advisory VUL, by contrast, doesn’t have an account value bonus and has asset-based expenses that vary by fund category. Tier 1 funds have no asset-based fee, Tier 2 funds have a 0.2% fee and Tier 3 funds have a 0.35% fee. If you add the asset-based fees to each fund by tier, here’s how they shake out:

A couple of things stand out when you look at Advisory VUL’s fund lineup this way. First, there are a lot of Tier 1 funds – 99, to be exact, or about 2/3 of the funds available in the product. Tier 3 follows with 29 funds and Tier 2 has just 16. Second, Tier 1 funds are really expensive. Why is that? Because these funds are generally actively managed and have some level of 12b-1 and/or revenue sharing arrangement that kicks fees back to Nationwide. The Tiering of the asset-based charge should theoretically equalize the revenue received by Nationwide across all of the funds, meaning that Nationwide isn’t risking its profitability based on how a client allocates their premiums.

This is the same strategy that is used by Monument Advisor. Despite the fact that the product was marketed as having only a $20 flat monthly fee, the reality was that JeffNat/Nationwide scrapes revenue from the funds to the tune of around 0.35% (Monument Advisor only had one tier at 0.35%). I’ve always viewed the marketing for Monument Advisor, especially during the JeffNat days, as disingenuous. To Nationwide’s credit, they don’t make a stink about Advisory VUL having no asset-based M&E charge or flat monthly fees or anything else. It just is what it is. And it makes a lot of sense – if funds have revenue sharing and/or 12b-1 fees in their VIT offerings and that’s what you have to work with, then you might as well set up this tiering structure so that customers don’t get hit twice through both inflated fund expenses and an M&E for certain funds.

However, these tiered asset-based fees have teeth. If you illustrate Advisory VUL using the weighted average of only Tier 3 funds against Nationwide VUL Accumulator with an all-fund weighted average, the two products are neck-and-neck. How is that possible? Because although VUL Accumulator has higher initial fixed charges and premium loads, it has essentially the same weighted average fund cost (once you include the Tier 3 expense in Advisory VUL) but VUL Accumulator has a 0.4% conditional bonus. In late policy years, that counts for a lot. In fact, if you look far enough down the illustration, VUL Accumulator starts to pull meaningfully ahead of Advisory VUL to the tune of 20-25bps.

The gap gets even bigger if you optimize your fund selection. For Advisory VUL, the perfect fund would be a cheap Tier 1 – but, unfortunately, that doesn’t exist. However, Advisory VUL does have a cheap Tier 2 option in the form of NVIT S&P 500 Index for 0.16%, giving it a total expense ratio of 0.36%. VUL Accumulator, however, has the same NVIT S&P 500 Index fund for 0.24% – which means that essentially the net expense ratio is negative 0.16% once you include the guaranteed conditional fixed interest bonus. Using these two equivalent funds, VUL Accumulator mops the floor with Advisory VUL at any point past the 25th year.

I think it’s a fair generalization to say that the appeal of Advisory VUL is its simplicity, low initial expenses and extensive fund lineup. It’s a fantastic solution for skeptical RIAs who are dipping their toes into the water of permanent life insurance and want a product that looks more like what they’re used to seeing in fee-based annuities and their non-insurance business. It’s impossible to fault Nationwide for their thoughtful and purposeful approach with this product. They know their audience and built accordingly.

But if you only care about long-term policy efficiency, VUL Accumulator is your ticket. The problem, however, is that long-term policy efficiency is only realized if a policy is well managed. Traditional VUL has an up-front commission for a lifetime of policy management, which usually means that the management doesn’t happen. If you want a well-managed policy, it would stand to reason that there needs to be ongoing compensation and, theoretically, the compensation will be offset by better policy management, portfolio performance and client experience. You need the advisor to be able to charge AUM on Advisory VUL.

Advisory VUL makes that easy. Other products that have paid asset-based compensation have set a certain schedule that applies to all policyholders. Advisory VUL, however, gives fee flexibility to the advisor. That’s a huge deal. Now, advisors can charge fees on Advisory VUL that are consistent with what they’re doing for the rest of the assets they manage for the client so that the policy can be fully integrated into the portfolio in terms of both asset allocation and fee consistency.

But the tradeoff is that the method of deducting the fee is quirky – it comes out as a policy loan. That’s what allows it to be fully flexible. Using policy loans also means that premium payments go first to pay down the loan balance, which reduces the net premium and, therefore, reduces the premium load. Very clever. The downside, though, is that it’s really transparent. Maybe a bit too transparent. One of the advantages of AUM arrangements is that the client doesn’t cut a check to the advisor. It just comes out of the funds. But that’s not what’s going on here. If the client is paying fees via loans, then they’re going to see the loan repayment or outstanding loan balance on the annual statement. That, I think, could spark some pretty interesting conversations.

The final piece to the puzzle for Advisory VUL is the experience provided to RIAs through Nationwide Advisory Solutions. The elusive dream of the life insurance industry for the past several decades has been getting financial advisors to cross over to selling life insurance. When Nationwide bought JeffNat, they didn’t just get the product – they also got the technology infrastructure and the personnel in Louisville. Advisory VUL is fully integrated into the NAS system, which means that RIAs will have basically the same issuing and managing experience Advisory VUL that they already are used to for other NAS annuity products. Add to that the ability to bill AUM from the product itself and a simple product story and maybe, just maybe, Nationwide will prove to have cracked the code on selling life insurance through RIAs.