#248 | The Price of a Term Conversion

When I have conversations with folks about term insurance, I always focus on term providing two distinct benefits – mortality protection and insurability protection. Mortality protection is the death benefit. That’s the low-cost, efficient and commoditized portion. Insurability protection is the conversion feature available in the product, which many consumers (in my experience) are only vaguely aware of. In terms of sheer utilization, the conversion privilege is arguably the most valuable part of the term insurance product. If only 1% of people die with a term policy, which is the oft-cited statistic, then surely a much higher percentage end up converting their term policy into a permanent product. There’s a much higher likelihood that a person has an insurability event than a mortality event over the guaranteed level term period. Conversion privileges are an unmitigated benefit for policyholders.

The strange thing is that there has traditionally not been an explicit cost for a generous conversion feature. Instead, life insurers simply baked it into the policy as a no-cost or embedded cost option. My hunch is that the reason is likely that conversion profitability (or, more accurately, unprofitability) is actually modeled in the permanent product pricing rather than the term insurance product. There is a conversion “tax,” if you will, baked into every permanent policy that is eligible for conversions. That’s a pretty inefficient way to price for conversions because all policyholders are therefore paying for the poor mortality of the few converting policyholders.

The solution is to introduce a conversion-only product, which allows the life insurer to concentrate pricing for conversion mortality in a single product rather than spreading it across all of the products. It depends on exactly the product, age and cell, but the pricing for conversion-only products is something like 40-100% more expensive on a level-pay basis than street retail products. It’s the equivalent of dropping from a Preferred Best rating to a Table B or lower. The ability to convert to any street product is a huge benefit to the consumer and, not surprisingly, it’s also a rapidly disappearing one. Increasingly, companies are restricting conversion to a conversion-only product or reducing or eliminating the ability to convert altogether.

One of the ways they’re restricting conversions is by offering fully-convertible term and restricted-convertible term along side one another. There’s a market price – albeit, a very spotty one – starting to emerge for the value of an unlimited conversion privilege. The term market appears to be in the very beginning stages of unbundling the value components of the term product in the same way that airlines did with low-cost tickets years ago. For the first time, we’re starting to get a feel for what certain elements of a term product are worth, especially when it comes to conversion privileges.

The clearest comparison is at PennMutual, which offers a non-convertible term product and a fully convertible term product with guaranteed conversion to any permanent product available, which is the most generous conversion definition. PennMutual has both ends of the spectrum covered. So what’s the price difference between the two products? About 7% for 40-50 year old males on $1M of death benefit for a 20 year product. North American also has the two ends of the spectrum covered. It offers Classic Term 15 with no term conversion privilege and ADDvantage Term 15 with full conversion. The price difference? Just 3.4% for the 40 year old, 2.12% for the 45 year old and 1.4% for the 50 year old.

Other companies offer conversion extension riders. At Principal, extending the conversion privilege from 15 years to 20 years costs 8% or more. Both MassMutual and Securian offer extension options from 10 years to 20 years, but the extension costs 7% at MassMutual and less than half of that amount at Securian for the exact same privilege. Strange, isn’t it? Conversions are an inexact science. Every carrier has its own conversion experience that may or may not be indicative of other carriers. Carriers with career agencies that sell term insurance and really play up the conversion privilege almost assuredly have a higher conversion rate than carriers working in the brokerage channel. It’s not surprising that such a carrier-specific metric produces carrier-specific pricing.

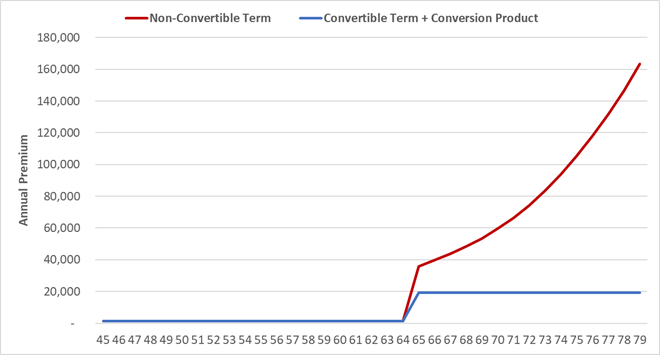

If you wanted to generalize, you might say that buying a term product and adding an unlimited conversion privilege costs about 7% of the premium. This is a steal. Think of it like buying an insurance policy on your convertibility feature. If you don’t use it, then you paid an extra 7% every year which, in term premiums, is effectively nothing. A 45 year old Preferred Male can buy a $1 million 20 year Term product from PennMutual for a mere $1,265 a year. Adding the conversion feature brings the price up to $1,354, a difference of less than $10 a month. Over 20 years, the total additional premium paid for the conversion feature is just $1,780. The cost is trivial. I know that the term market is monstrously commoditized and clients tend to equate paying the lowest premium with having the “best” policy, but that’s fool’s gold. Just take a look at the price difference post-level period for keeping the non-convertible term policy or converting to today’s pricing on a Guaranteed UL product.

At age 78, the total premium paid into the non-convertible term product exceeds the death benefit, ringing in at $1.125M. Over the same period of time (and assuming today’s pricing on the conversion), the total amount paid in the convertible product is just under $300,000. In this example of a client who is obviously uninsurable but healthy enough to live for 15 years or so, their additional $1,780 paid over 20 years saved them a whopping $828,000 in additional premiums over the long run.

If you want to think about this math in terms of insurance pricing, then think of it this way – what percentage of clients would have to convert in order to justify the extra $1,780 and make it a net-neutral proposition on average? Just 0.21% of all policyholders. The pricing, in effect, is saying that after 20 years only 0.21% of all 45 year old Preferred males who bought this term policy will be uninsurable and will get the benefit of the conversion feature. That seems a bit on the low side, doesn’t it? And that makes this conversion feature appear to be a screaming deal for policyholders.

What about these term extension options? They’re a bit trickier. Is it worth paying an extra 8% at Principal to be able to convert in the last 5 years of a 20 year policy? What about 7% at MassMutual to pick up the last 10 years? What about 3% at Securian for the same benefit? The math isn’t as clear. We’re deep into the actuarial murk. One could argue that a client can make that call 10 years into the policy, but then why not just have the client buy a 10 year term contract if conversion is a major reason for buying the coverage? Some clients might think it’s worth the extra cost, other clients might not.

Historically, it’s been hard to get clients to focus on anything other than price when it comes to term insurance. I remember when we lowered our term premiums at MetLife to $1 less than the #1 ranked product across the board and our sales run rate more than tripled practically overnight. Price matters in term insurance, but the reason why is that clients think they’re buying death benefit protection when they buy term insurance. They’re buying that, yes, but they’re also buying insurability protection – they just don’t know it.

But as life insurers unbundle their term offerings so that they can offer stripped-down products at the lowest possible cost, they’re also going to be highlighting to clients that term is more than just about death benefit protection. For the first time, clients will be able to see the price of a conversion privilege on a standalone basis and ask “what’s that?” My gut is that when they understand what a conversion privilege is, they’re going to immediately understand the power in it and they’re going to be willing to pay for it. The idea of becoming unhealthy rings true with everyone. It’s one of our biggest fears. Conversion privileges help to hedge that risk. By breaking out the pricing for various term features, life insurers might have stumbled on how to de-commoditize the category. Who knows? They might even be able to finally convince people that there’s more to term insurance than dirt-cheap premiums. And that’d be something to celebrate.