#422 | Equitable Exits Third Party Distribution

At the tail end of last year, Equitable announced that it has decided to “focus our life insurance third-party distribution efforts exclusively on our COIL Institutional Series” and “will no longer accept new life insurance applications for all other products through our third-party distribution partners.” Equitable is announcing what amounts to an exit from third-party distribution – it just can’t quite bring itself to use that word.

You might be forgiven for thinking that Equitable had already exited third-party distribution. Through Q3 of 2024, third-party distribution (TPD) accounted for just under 20% of total sales at Equitable and just 0.5% of TPD sales across the whole industry. To put that into context, Nationwide has sold 20 times more premium in TPD than Equitable. I would bet that 20 years ago, the comparison between Nationwide and Equitable would be reversed.

The problem at Equitable isn’t just that it wasn’t selling much in TPD – it was that Equitable was selling the wrong stuff. The vast majority of TPD sales came from Equitable’s recently released, moderately competitive Guaranteed VUL product. Equitable has made no bones about the fact that it doesn’t love long-term guarantees. The fact that TPD was selling primarily Guaranteed VUL is a vote against it, not for it. As a result, it’s not surprising that Equitable would refocus its efforts towards Equitable Advisors and leave TPD behind.

This ends the life insurance side of a long chapter of Equitable’s history that started in the late 1990s with the creation of AXA Distributors. Like many insurers in the 1990s, Equitable saw an opportunity to branch out from its traditional career distribution force to independent agents and brokerages. The impetus, back then, was the industry’s shift towards both variable life and annuities. As of 1994, 75% of Equitable’s new premium was in variable products. Little wonder why Equitable, with its new French owner, wanted to stretch its wings to broader distribution with more registered reps.

AXA Equitable remained a dominant seller of Variable Annuities during the living benefits wars of the early 2000s with much of that production coming from its TPD channels. In 2010, AXA released Structured Capital Strategies, the first RILA product, to exactly zero fanfare. I still remember watching AXA wholesalers give presentations on SCS and seeing advisors yawn and completely dismiss it. But over the past decade, RILA has grown into the largest category of variable annuities and SCS has never been dethroned from the #1 spot.

On the Life side, AXA Equitable took a different turn. Industry Variable UL sales fell from 47% in 2000 to just 21% by 2004. At the same time, Guaranteed UL hit the market and UL sales exploded from 23% to 48% of overall industry sales. AXA was a big part of that story. I remember this era well Athena UL was the flagship product and it was highly competitive – which is to say, drastically mispriced. As a result, AXA seemed to attract more than its fair share of the bad business that was flowing through the industry in those heady days.

Falling rates after the Financial Crisis flowed directly through to European and Canadian insurers. In short succession, AXA and then John Hancock dropped their best-selling Guaranteed UL offerings. But unlike John Hancock, AXA never really created a death benefit product to fill the gap. Athena UL was revised to compete as a current assumption product but AXA, almost inconceivably, supported it with a new portfolio in the midst of a depressed rate environment. Crediting rates on Athena UL were in the low 4% range. It never stood a chance compared to John Hancock Protection UL, not to mention the plethora of US insurers who were still offering cheap Guaranteed UL.

Instead, AXA made a pivot to Indexed UL. It was early to the IUL game when it launched Athena IUL in 2010, but the second version released in 2012 really caught a head of steam. Part of the reason was that AXA was one of the first companies to offer buy-up Caps before AG 49-A changed the game. But much more importantly, Athena IUL paid a lot of compensation. So much compensation that it attracted certain rebating schemes in California to such a degree that AXA eventually had to take a write down, but that’s a story for another day. The upshot is that once the questionable Athena IUL business dried up, AXA’s presence in third-party distribution diminished to almost nothing and never recovered.

That is, in my view, as much of a statement about Equitable as it is a statement about the fickle nature of third-party distribution. Equitable certainly tried to remain relevant. It kept a wholesaling force and continued to sponsor events. It periodically offered competitive Term rates and rolled out innovative products such as Advantage Max and MSO II. And despite all of the turmoil at other insurers, Equitable has maintained sterling financial strength and currently sports a $15.2B market cap, three times the size of Lincoln and six times the size of Brighthouse. By every indication, Equitable should have stayed relevant in TPD.

The problem was that Equitable wasn’t offering exactly what TPD wanted – aggressively illustrated Indexed UL, rock-bottom Term pricing or cheap lifetime guarantees. Every life insurer likes to think that they have unique franchise value, but the reality is that there is essentially no such thing as franchise value in TPD. It’s a lesson that life insurers can only learn the hard way. Just ask Global Atlantic, SunLife, Voya or Genworth, all of which tried to leverage longstanding relationships in TPD to pivot to more sustainably priced products and failed. Add Equitable to the list.

However, Equitable does still have something that it thinks has some play in third-party distribution – its vaunted Corporate-Owned Incentive Life (COIL) product. COIL was released in 2008 as the 2001 CSO successor to Incentive Life COLI 04. My recollection is that the philosophy behind COIL and its predecessors was always that it was a Corporate Owned Life Insurance (COLI) product designed for smaller companies while retaining some of the key attributes of COLI, chief of which being early cash values in excess of premiums paid.

Pulling that off is harder than it sounds. The reason traditional COLI can offer cash value in excess of premiums paid is because it is used in a plan with dozens or even hundreds of participants and there is very little risk that the cash value will be surrendered. The fact that COIL offered a similar benefit but for smaller cases represents a real policyholder behavior risk that requires real-world experience to quantify. You basically have to be in market to know how to deal with it – and Equitable is essentially the only company that has been in market long enough to have the data. Equitable even feels so confident in its experience that it will allow COIL to be sold in certain business-sponsored scenarios that are essentially individual retail sales, which dramatically expands the potential market and sales applications for the product.

It’s not often that pure experience data is a competitive edge but, in the case of COIL, that seems to be part of the story. And it shows. No other product in the industry that is available for individual cases does quite what COIL does. Riders that either waive surrender charges or provide an enhanced cash surrender value are far less common than they used to be.

I did a quick scan through WinFlex and found around 13 carriers with high early cash value riders. Most of the riders were just waiver of the surrender charge. Principal has riders that provide cash surrender value equal to premiums paid for a certain period of time. But only three riders have the possibility of offering cash values in excess of premiums paid in year 1 – Prudential, Penn Mutual, Lincoln and, of course, Equitable COIL.

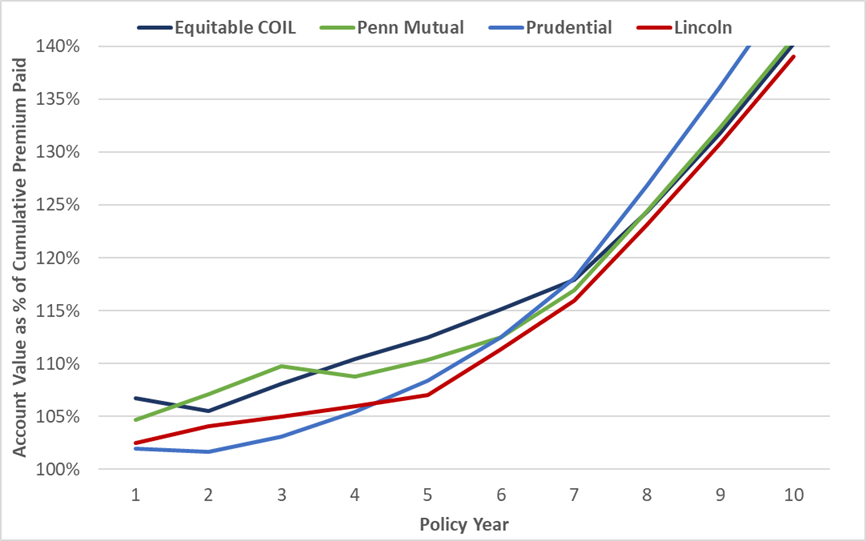

All three products have a similar structure in that they provide an “enhanced” amount that pushes the cash surrender value above the account value. For this cell, I ran a 45 year old Preferred male with a $100,000 premium for 7 years at the minimum non-MEC level death benefit under CVAT, which was around $1.36M for this cell. All products are VULs and all of them use a 7% net illustrated rate. Cash values are below as a percentage of cumulative premium through policy year 10:

The mechanism for delivering higher earlier cash values for all four of the policies is some sort of enhanced amount that is added to policy values. Each product does it slightly differently, which is why the lines are jagged. Equitable holds the edge in year 1 and generally until year 7. It is clearly the richest of all the riders, although Penn Mutual isn’t far behind.

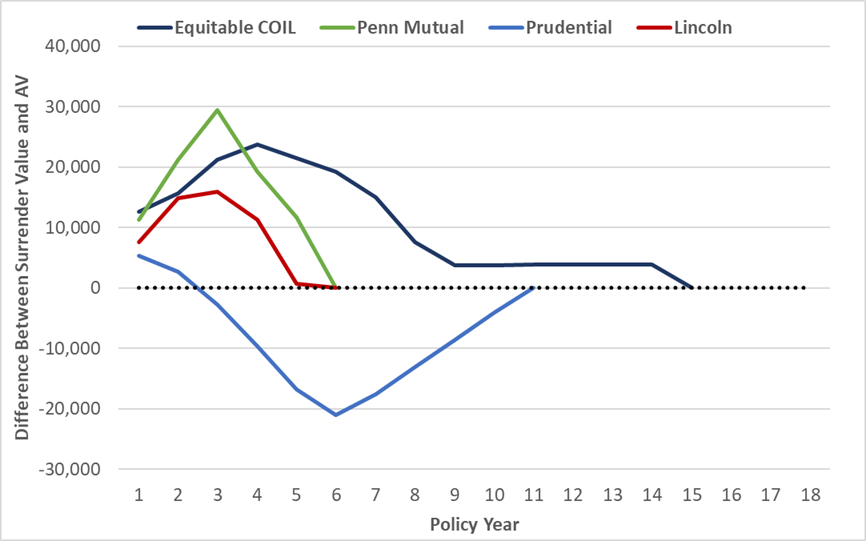

Prudential has the weakest benefit, in part because it uses a different structure than the other riders. Equitable, Lincoln and Penn Mutual all waive surrender charges and add the enhanced amount to the account value itself. Prudential, however, keeps the surrender charges and simply offsets them with the enhanced amount – but not fully. After year 2, the cash surrender value slips back below the account value due to the surrender charges. Take a look at the difference between the surrender value and the account value for all four products:

The richness of the benefit is, of course, also directly related to the cost. Lincoln, Penn Mutual and Prudential all break out the cost of the rider separately. Lincoln charges an additional amount from years 2-5 that tallies up to $9,405 on a Net Present Value basis using a 7% discount rate, the same as the net growth assumption for the account. Penn Mutual charges an extra fee for the first 10 years that works out to a little over $10,000 in NPV. Prudential’s benefit is by far the weakest and it is, as you would expect, by far the cheapest – just $570 in the first year.

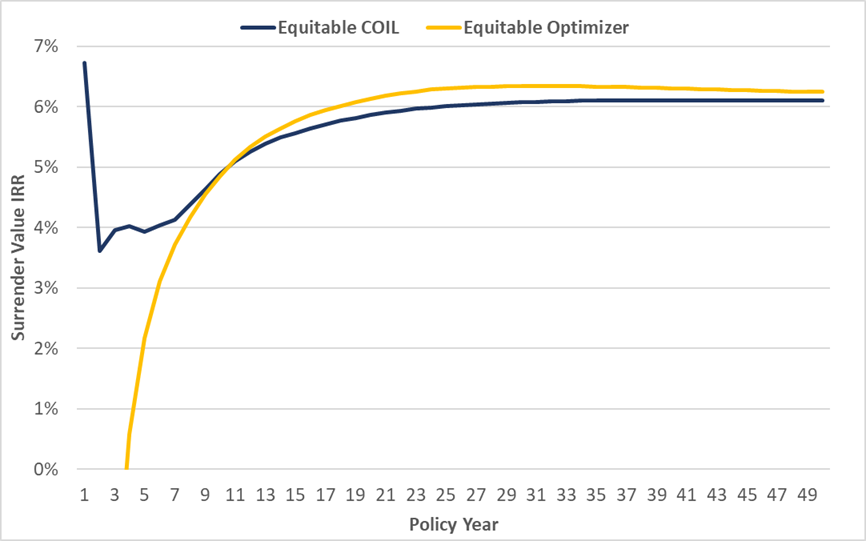

The math for COIL is trickier. There is no option to remove the enhanced cash surrender value, so the only point of comparison is Equitable’s individual retail accumulation product, Optimizer VUL. There is a clear tradeoff between the two products – COIL wins in early durations, Optimizer takes the cake in longer durations. Take a look at the IRRs of the two products over time using the same client, net assumed rate and funding pattern:

In broad strokes, the enhanced surrender value benefits of COIL ends up costing about 20bps in the long run, although the gap is higher at middle durations and lower at later durations. COIL has higher policy charges than Optimizer ($11,336 on an NPV basis) but most of the performance gap is due to the fact that Optimizer has an interest bonus (the Customer Loyalty Credit) that starts in year 10 and no M&E after the 8th year. COIL, by contrast, has an M&E throughout with no interest bonus.

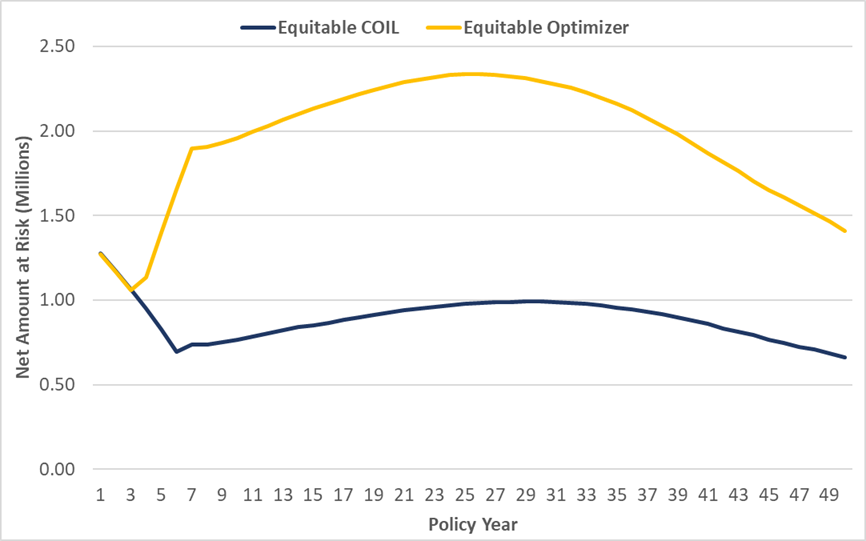

The other quirk between the two products is that Optimizer carries a lot more death benefit than COIL. The same is true for GPT designs as well. The reason seems to be that Optimizer is still running on the old 4% 7702 limits, as crazy as that sounds. Take a look at the DB IRR comparison to see just how much more coverage Optimizer is carrying:

If the policies carried the same death benefit, then the gap between the long-term performance of Optimizer and COIL would be quite a bit bigger – maybe even as much as 20bps, putting COIL more like 40bps behind Optimizer. For Prudential, the cost is negligible. Lincoln is less than a couple of basis points. Penn Mutual is about 5bps. Put into the context of the other products, 40bps for COIL’s enhanced cash surrender value is steep. And if you compare COIL to Prudential or Lincoln, both of which are generally more competitive in terms of CSV IRR than Optimizer anyway, the gap widens to more like 60bps.

But COIL also has by far the richest benefit and the most accessible benefit given that the other riders have to be purchased by a business. The natural question is whether or not the benefit is worth the drag – but I actually think that’s the wrong question. Optimizer and COIL are going after two distinct markets. Optimizer is a traditional retail product sold to individuals. COIL is primarily designed for sales scenarios where a traditional retail product won’t work. The client wants to see cash value growth that is very, very close to the underlying net performance of the subaccounts and that’s exactly what COIL gives them.

Is there a place for that story in third-party distribution? Given the scarcity of similar riders across the industry that deliver as much initial performance as COIL and are available for individual sales, there probably is a small market in TPD for COIL. Equitable distributes COIL through its Corporate and Endowment Solutions (CES) arm, which delivers a bespoke set of services in conjunction with COIL that may substantially enhance the appeal of the product for complex or administration-heavy cases. It’s not expensive for Equitable to give a free hand to CES to drum up business anywhere and that’s what it looks like Equitable intends to do by keeping COIL open for everyone.

The question is what comes next. Equitable was once an enormous player in the life insurance market and it seems to have retained much of that infrastructure that may be overkill given its current levels of production. Exiting third-party distribution is one way to trim the infrastructure in order to remain focused on its core market, Equitable Advisors.

The opportunity there is enormous. Equitable Advisors, like many other financial planning firms, has shifted more towards annuities and assets under management and away from life insurance over the past 30 years. The Life division of Equitable has a shot to convince its advisors that life insurance belongs in every financial plan and that Equitable products deserve first look.

The prize is real. Just look at Northwestern Mutual, which handedly outsells Equitable even in VUL, which is Equitable’s exclusive focus. Why? Because NM reps believe that every financial plan should have life insurance. The road ahead for Equitable isn’t just about new products, modern underwriting and better operations – it’s about convincing Equitable Advisors, for the first time in a long time and maybe for the first time ever, to incorporate life insurance into financial planning. The future of life insurance at Equitable depends on it.