James Christie | Here We Go Again – With A Twist

The story currently playing out in the bond and equity markets seems eerily similar to what we saw in 2008 and 2009. Significant volatility in the equity markets combined with declining interest rates and rate actions by the Fed. In typical fashion, investors are seeking safety in government bonds even with yields at record lows. Fleeing more aggressive positions in equities, oil and commodities, and cryptocurrencies. Even though this feels the same, it is still very different. Overlaying the current epidemic of COVID-19 brings a far more sinister view of what is happening and what could be happening over the next 6-12 months in the marketplace.

There are really two things at battle here. The actual disease itself and the impact it is having on people across the globe. That potential peril so far has been exceeded by the disruption that it can have on the global economy. Factories have cut output, athletic events are being played in empty stadiums, flights with 2 passengers. Demand is down and that is never a good thing for the economy, especially when you couple it with the “new norm” of the 10-year treasury. Essentially, our starting point is so much lower today than it was in 2008, where can we actually go?

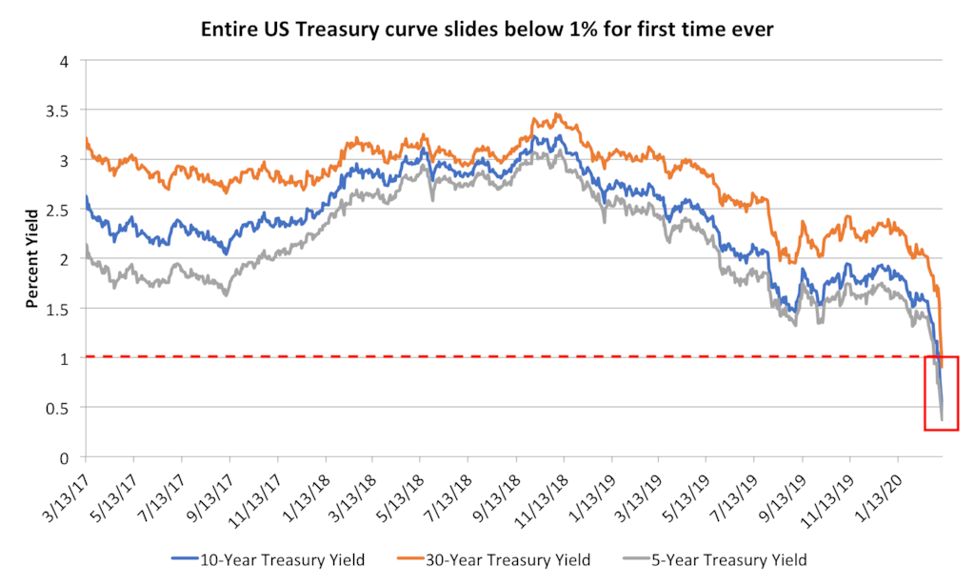

The 10-year opened 2008 at 3.91%. It opened 2020 at 1.88%. Look at the chart below.

You could argue things had kind of leveled out and were at least tolerable for a while from a bond perspective. Unfortunately for life insurers, this “new norm” was already putting pressure on product manufacturing. Profitability from life insurance products was already strained as carriers continued to try to find ways to drive sales while earning some sort of meaningful margin. The “new norm” hurt, but it was manageable. Unfortunately, it was manageable because many relied on rates going up. The forward curve was something used during pricing that gave some relief to a bleak outlook on product profitability.

Take a look at that curve, not exactly the way it was supposed to go. It would be like you are a quarterback and were expecting a corner post route and the receiver ran a hook. You either got fooled and threw an interception, got sacked, or got lucky and completed a small pass. None of these results are particularly attractive.

The real problem with all of this comes when you overlay COVID-19 and its potential impact. Are we really talking about interest rates at 0%? How does an insurance company operate in a world of interest rates that are that low? Especially when at this point in 2020 they were hoping for some relief. What if rates stay this low for an extended period of time? Not a pretty picture.

Bobby and I have already talked at length about the caps on IUL products and the pressure they were under. The “Cap-tastrophe” was already under way and we were seeing it across the board in the IUL space. What we will start to see in the marketplace are things like:

- Cap Decreases – more of them

- Changes to Non-Guaranteed Elements – Think bonuses/multipliers

- Product Repricing – significant, especially in the guaranteed space

- Limits on DB

- Limits on Premium – especially in early funding scenarios

- Carriers Halting Sales of Certain Products

- COI adjustments

Look familiar? It should. So, what do you do?

- First off, de-risk your product set. What I mean by this is make sure the product you are recommending is not filled with non-guaranteed elements that can be adjusted. In addition, run at rates that can withstand some changes that could come that would affect the potential upside you are illustrating. Be more conservative.

- If you are buying guarantees, by those now. Prices will go up. Carriers will start to put band-aids on their products such as premium and DB limits on their products and we are already starting to see it. They do this because they need time to reprice and they don’t want to take on significant amounts of premiums on products that are unprofitable.

- Look for value. VUL is a good option. The pricing structure of the product is better for the carrier, not as general account intensive. Never mind the fact that if equities are down, it could be a good time to buy. Not making a recommendation to purchase equities because there would need to be a considerable amount of research done with a client to make this type of recommendation, but something to consider.

- Plan ahead. The policies you sold over the last 10 years will likely have changes made to them that hurt the potential upside. Are there things you can do today to help make sure that the client still feels good about what they purchased?

It is also important to note that many carriers are putting travel restrictions in place for the UW process. Be aware of what those might be and how it could impact a client getting coverage. It started with travel to China, but it inevitably will expand and become more robust.

You may read this and think it is doom and gloom, but we have already lived this and there are a few additional variables to this equation that should have you at the very least mildly concerned. The 10-year was already low and has been low for quite some time. Carriers had been relying on it to trend up and it has gone the other way completely. While we can’t be sure for how long, it doesn’t really matter. It hurts now and the longer it goes on, the bigger the wound will be. They will apply band-aids, but eventually those don’t work and something more drastic will need to be done. The second variable is COVID-19, which we clearly did not have the last time around. As this disease spreads, the potential impact on the global economy is massive. You don’t need a crystal ball to see how this thing continues to play out in the short term.

At the end of the day if it ends up being more bark than bite, then who cares? If you followed the actions above you would have de-risked your product set, obtained necessary coverage for your clients, found new valuable solutions, and set better expectations with your clients. Prepare for the worst, hope for the best, plan for the variables, and wear a mask.